Why VERO and not the other guys?

There are many providers that can verify identity and income and screen rental applicants.

Here's what makes VERO different:

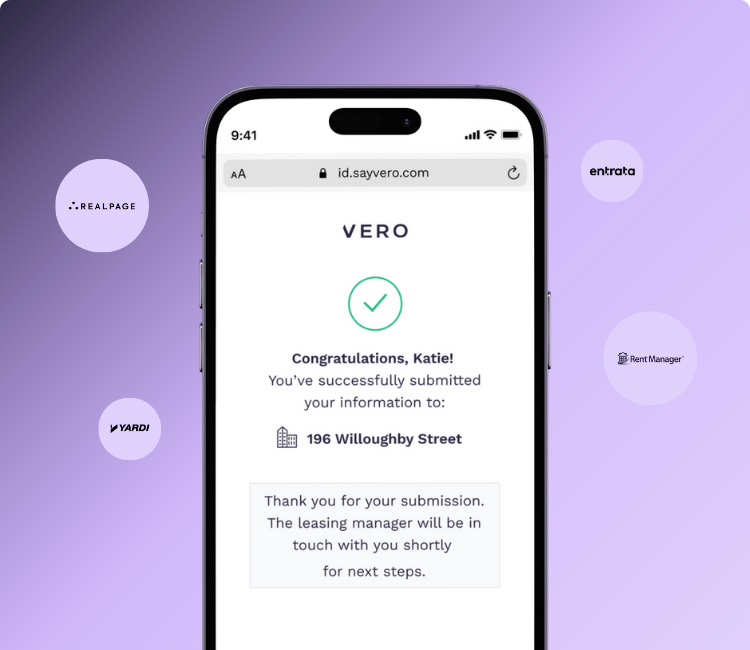

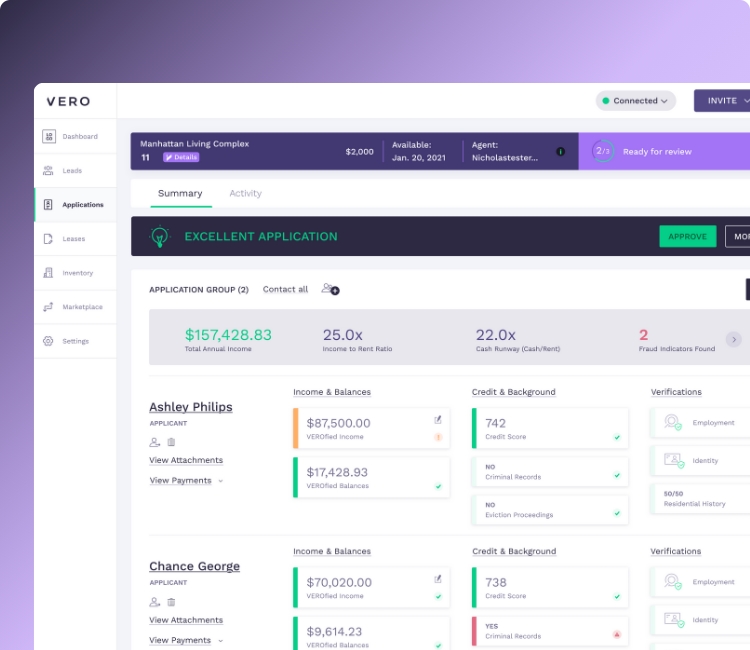

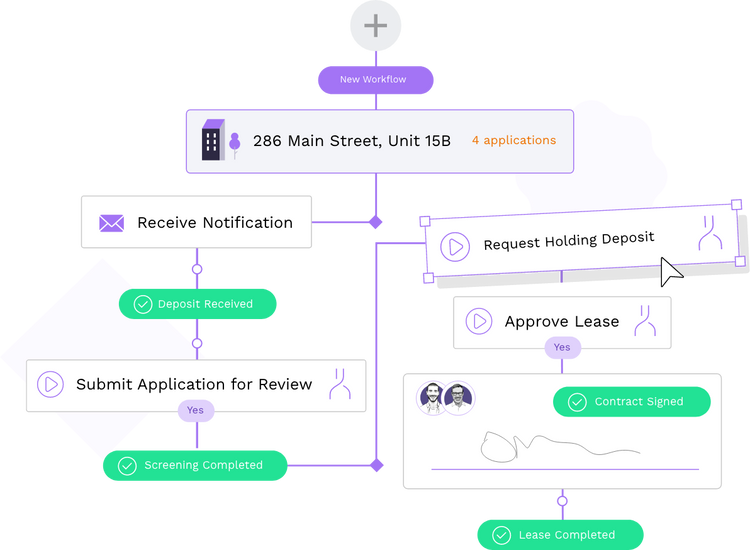

Single unified workflow

VERO combine identity, income, credit, background, fraud analysis, and decision guidance into a single, easy-to-use applicant workflow that syncs results directly with your property's PMS. Renters move forward faster, teams work from a single source of truth, and nothing gets lost across disconnected tools or manual handoffs.

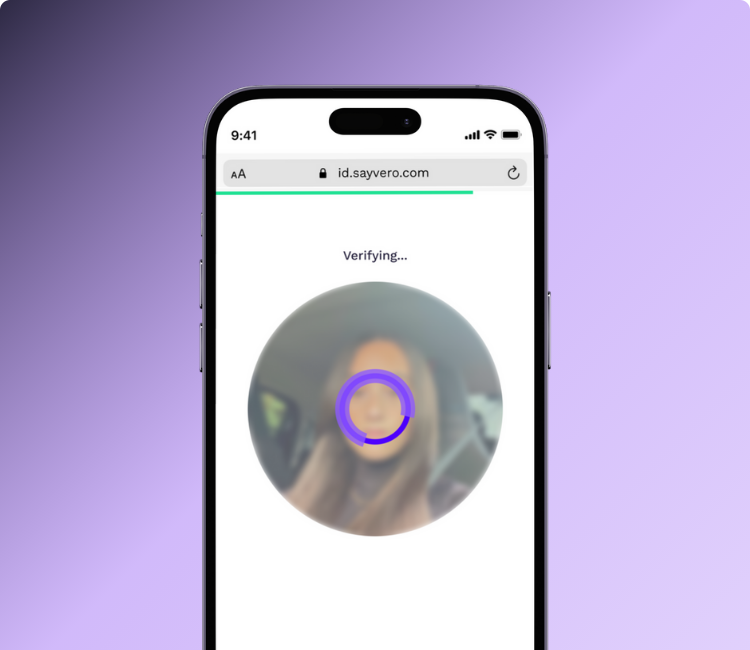

Biometric ID matching

Applicants are prompted to take a live selfie image, which VERO compares against the photo on their government ID using advanced facial recognition technology. This liveness detection step confirms that the person applying is physically present and matches their photo ID, stopping would-be fraudsters.

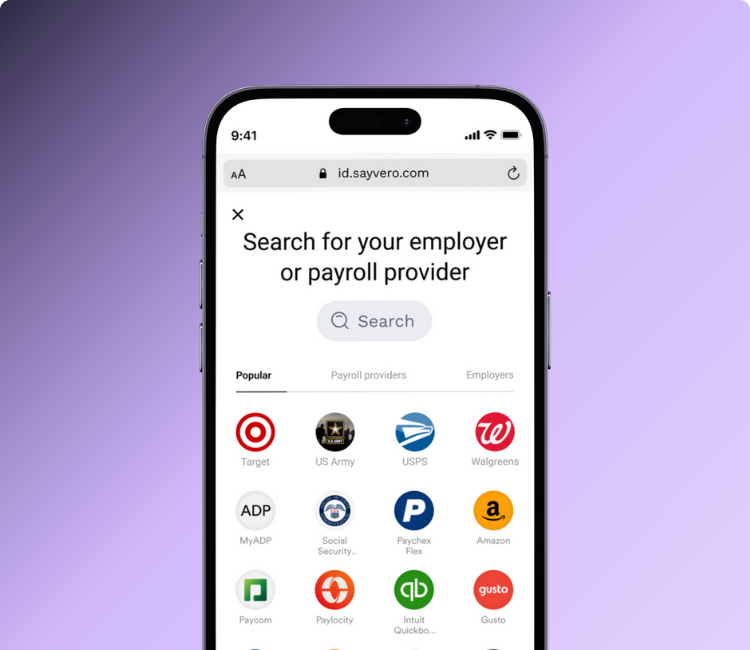

Direct income verification

Applicants securely connect to their payroll provider or bank account, allowing VERO to verify deposits only from known payroll providers and payment platforms, not every transaction. This helps onsite teams quickly confirm income and employment without chasing documents and protects renters' privacy.

All income types supported

VERO evaluates consistent payroll deposits across multiple income sources to verify what an applicant can reliably earn. Additional recurring deposits from gig work or peer-to-peer apps are surfaced separately, giving teams visibility without inflating risk, so onsite teams can confidently qualify the right renters.

Built-in protection services

VERO embeds approved lease guarantor and insurance products directly into the applicant experience. When an applicant falls short, it doesn’t mean “no.” Applicants can be offered the right options to move in, often with lower upfront costs. Properties reduce conditional approvals and keep welcoming qualified renters.

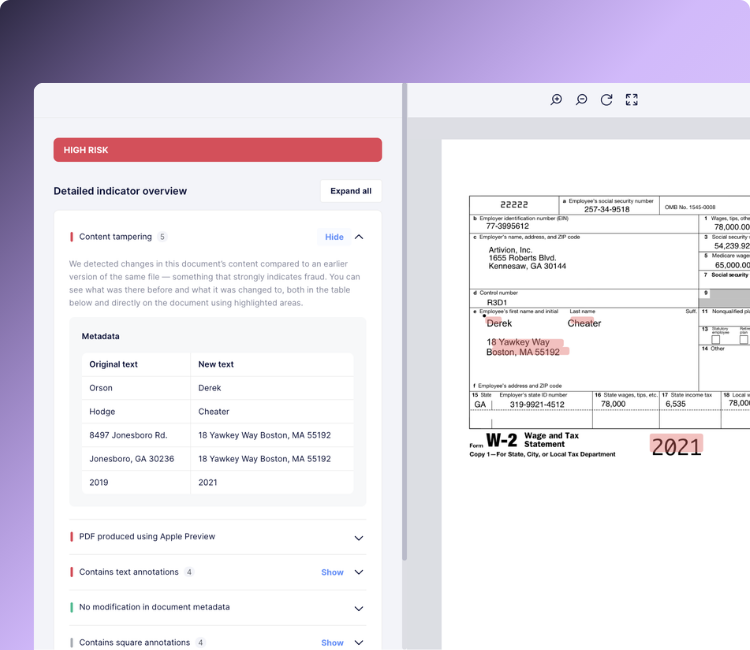

Document fraud loop

VERO uses automation and AI to analyze uploaded documents beyond the surface, showing what was altered, where the tampering occurred, and how it was done. This transparency gives onsite teams confidence in the leasing decision, helps them understand real risk, and makes fraud prevention easier to act on.

Built-in decision engine

VERO consistently applies each property’s rental criteria and SOPs to every application. Instead of simple pass-or-fail results, it guides and recommends next steps for onsite teams, reducing risk and ensuring faster, compliant decisions even as staff changes occur.

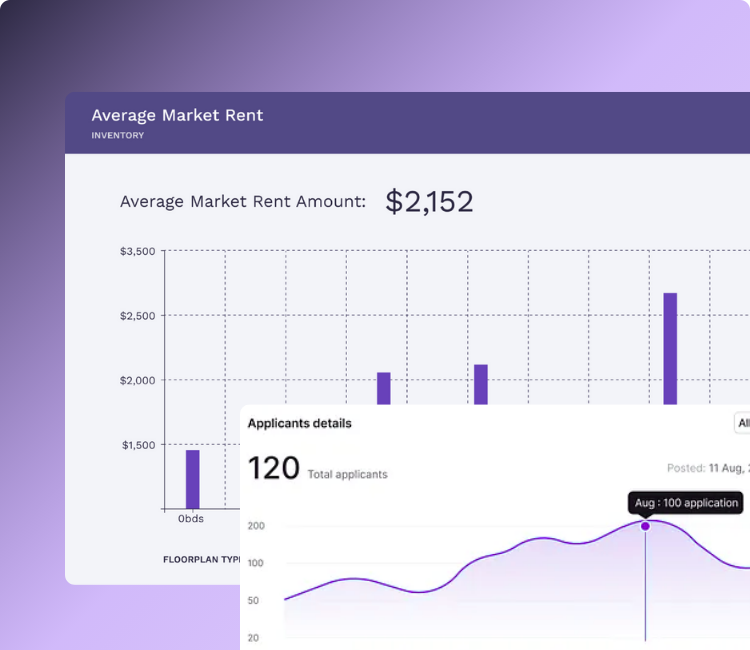

Portfolio-wide visibility

VERO gives operators and owners real-time visibility into screening activity, risk trends, and application outcomes across every property. With consistent criteria, transparent decisions, and shared insights, teams stay aligned, and leasing performance remains predictable.

Fanatical support

VERO pairs its risk management platform with real, operator-focused support. From onboarding to rollouts, leasing teams get fast, expert help when it matters, not tickets lost in a queue. Well-run communities depend on technology backed by dependable support.

-1.svg) Built to protect sensitive financial data

Built to protect sensitive financial data

At VERO, we recognize that verifying income involves sensitive financial information. Our SOC 2 compliance ensures that every step—from payroll and bank connections to reporting—meets high security and confidentiality standards. Applicants can trust that their financial details remain confidential, while operators have peace of mind knowing verifications are conducted in a secure, audited environment.