CREDIT & CRIMINAL CHECKS

See the full picture behind every application

VERO's credit and criminal background screening helps operators accurately assess financial reliability and community safety. With real-time data from major credit bureaus and national criminal databases, you get the clarity needed to approve residents without the risk.

Comprehensive applicant insight

VERO unifies major bureau credit data and nationwide criminal records into one report, giving you a clear picture of each applicant’s financial reliability, rental history, and potential risk—all in real time.

Fast, consistent decisioning

Tailored credit and background criteria are applied automatically across your portfolio. VERO scores, flags, and recommends outcomes to ensure every leasing decision is fast, fair, and fully documented.

Verified accuracy & fraud protection

Reports are cross-checked with identity and fraud databases and reviewed by experts to prevent false matches or CPN usage. You see verified, trustworthy data before making any approval decisions.

Secure, compliant, and transparent

Every screening runs within VERO’s SOC 2– and FCRA-compliant system, with automated disclosures, adverse-action support, and encrypted data handling—protecting both your properties and your applicants.

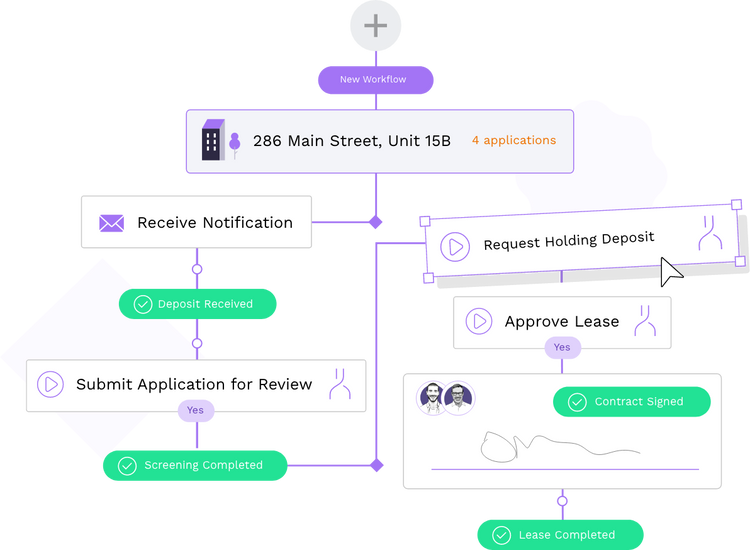

VERO combines credit and criminal data with other signals to predict applicant suitability

By analyzing financial history, payment behavior, and background records alongside verified income, identity, and document data, VERO delivers a complete risk profile.

.jpg?width=1406&height=1218&name=Fast%20process%20(31).jpg)

.jpg?width=1406&height=1218&name=Fast%20process%20(16).jpg)

.jpg?width=1406&height=1218&name=Fast%20process%20(26).jpg)

SOC 2 Compliance: Protecting Sensitive Data

At VERO, we recognize that verifying credit and background data involves sensitive information. Our SOC 2 compliance ensures that every step meets high security and confidentiality standards. Applicants can trust that their financial and background details remain confidential, while operators have peace of mind knowing verifications are conducted in a secure, audited environment.

WHY VERO

A platform that is all benefits

Fragmented tools create data silos, manual work, and inconsistent decisions. VERO unifies screening, protection, and risk management into one intelligent workflow that delivers speed, accuracy, and control to every lease.