INCOME VERIFICATION

Verify an applicant’s ability to pay rent and lock out fraud

VERO verifies income directly from trusted sources. Instead of relying on pay stubs or uploaded documents that are easy to alter, VERO connects to banking and payroll systems to deliver accurate income and employment data, helping you approve qualified renters faster.

Direct payroll and bank integration

Applicants securely connect to their payroll provider or bank account, allowing VERO to verify deposits from known payroll providers and payment platforms only, not every transaction. This helps onsite teams quickly confirm income and employment without chasing documents and protects renters' privacy.

All income types supported

VERO evaluates consistent payroll deposits across multiple income sources to verify what an applicant can reliably earn. Additional recurring deposits from gig work or peer-to-peer apps are surfaced separately, giving teams visibility without inflating risk, so onsite teams can confidently qualify the right renters.

Comprehensive income analysis

Our platform doesn’t stop at checking gross salary. We cross-reference income data with the applicant’s identity to ensure it actually belongs to them and run a net cash flow and expense analysis for a realistic view of affordability, so you can approve quality renters, not just those who look good on paper.

Fraud detection on documents

If applicants upload documents (like pay stubs or bank statements), VERO uses OCR and fraud algorithms to spot any tampering or fake documents automatically. Any inconsistencies trigger a flag for review, protecting you from altered income statements that could lead to evictions later.

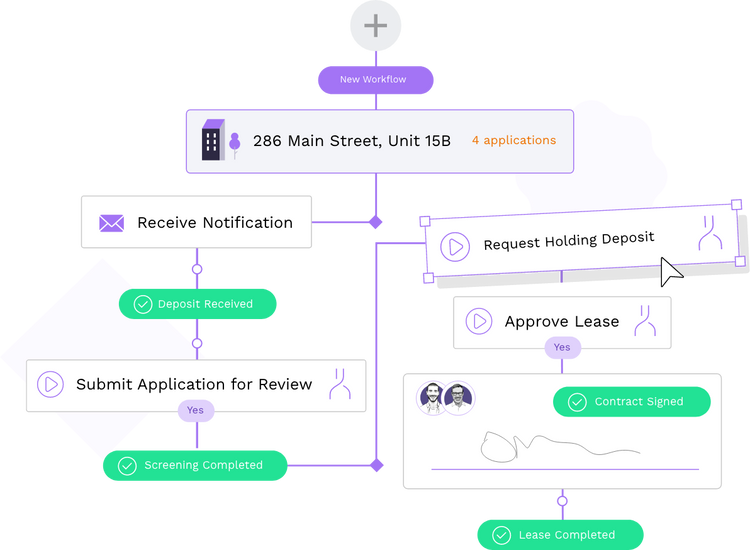

A fast, automated income verification process built for accuracy and trust

Applicants connect payroll or bank accounts in seconds while VERO verifies income directly at the source, analyzing deposits and employment data to deliver instant, verified results.

.jpg?width=1406&height=1218&name=Fast%20process%20(24).jpg)

.jpg?width=1406&height=1218&name=Fast%20process%20(12).jpg)

SOC 2 Compliance: Protecting Sensitive Financial Data

At VERO, we recognize that verifying income involves sensitive financial information. Our SOC 2 compliance ensures that every step— from payroll and bank connections to reporting—meets high security and confidentiality standards. Applicants can trust that their financial details remain confidential, while operators have peace of mind knowing verifications are conducted in a secure, audited environment.

WHY VERO

A platform that is all benefits

Fragmented tools create data silos, manual work, and inconsistent decisions. VERO unifies screening, protection, and risk management into one intelligent workflow that delivers speed, accuracy, and control to every lease.