IDENTITY VERIFICATION

Prevent identity fraud and leasing scams with fast, secure ID checks

VERO’s identity verification solution ensures that each applicant is who they claim to be, so you never hand keys to an impostor. Using advanced biometrics and document authentication, VERO verifies government-issued IDs and matches them to live selfies, all within a simple workflow. The result is a frictionless bank-grade identity check that catches fake IDs and stolen identities.

Biometric ID matching

Applicants are prompted to take a live selfie image, which VERO compares against the photo on their government ID using advanced facial recognition technology. This liveness detection step confirms that the person applying is physically present and matches their photo ID, stopping would-be fraudsters.

Authentic document checks

VERO scrutinizes the applicant’s identification document with multi-layered security checks to ensure it’s legitimate. Hologram analysis, barcode validation, and other forensic checks are applied to detect any forgery or tampering. If an ID isn’t genuine and unaltered, VERO will know.

Global ID coverage

Whether your applicant is local or relocating from abroad, we have you covered. The VERO platform can validate thousands of government ID types, leveraging global databases of official ID formats and security features. From US driver’s licenses to international passports, VERO’s identity engine verifies them all.

Fraud flags & watchlist screening

VERO cross-references applicant identity data against fraud and compliance watchlists. It detects invalid or fraudulent Social Security Numbers and checks sanctions lists. These checks add another Fraud Shield layer, helping catch synthetic identities or flagged individuals early.

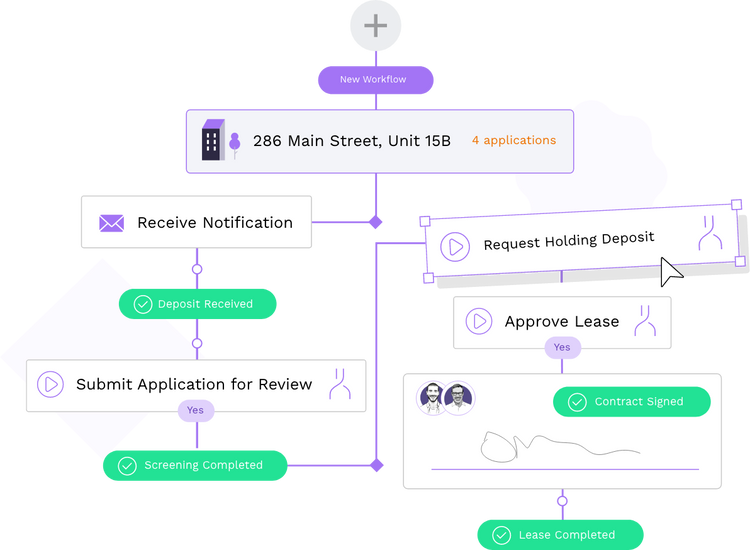

A fast and secure multi-layer identity verification process built for multifamily

Applicants complete ID checks in minutes while VERO runs real-time authenticity and fraud detection behind the scenes, giving your team instant, verified results.

ID scan

Applicants start by scanning a government-issued ID using their phone or computer camera. VERO instantly authenticates the document across thousands of templates and databases, checking holograms, barcodes, and embedded data for signs of tampering. Whether the ID is issued in the U.S. or abroad, VERO validates it against official standards in real time, ensuring only genuine credentials move forward.

.jpg?width=1406&height=1218&name=Fast%20process%20(13).jpg)

.jpg?width=1406&height=1218&name=Fast%20process%20(13).jpg)

.jpg?width=1406&height=1218&name=Fast%20process%20(14).jpg)

.jpg?width=1406&height=1218&name=Fast%20process%20(15).jpg)

Built for privacy and compliance

All ID verification steps are handled via encrypted, secure channels with respect for applicant privacy. VERO’s approach is Fair Housing and FCRA-compliant, applying the same objective standards to every applicant and providing an independent, bias-free verification that helps prevent discrimination. You get a reliable identity check that keeps your community safe while treating every renter fairly.

WHY VERO

A platform that is all benefits

Fragmented tools create data silos, manual work, and inconsistent decisions. VERO unifies screening, protection, and risk management into one intelligent workflow that delivers speed, accuracy, and control to every lease.