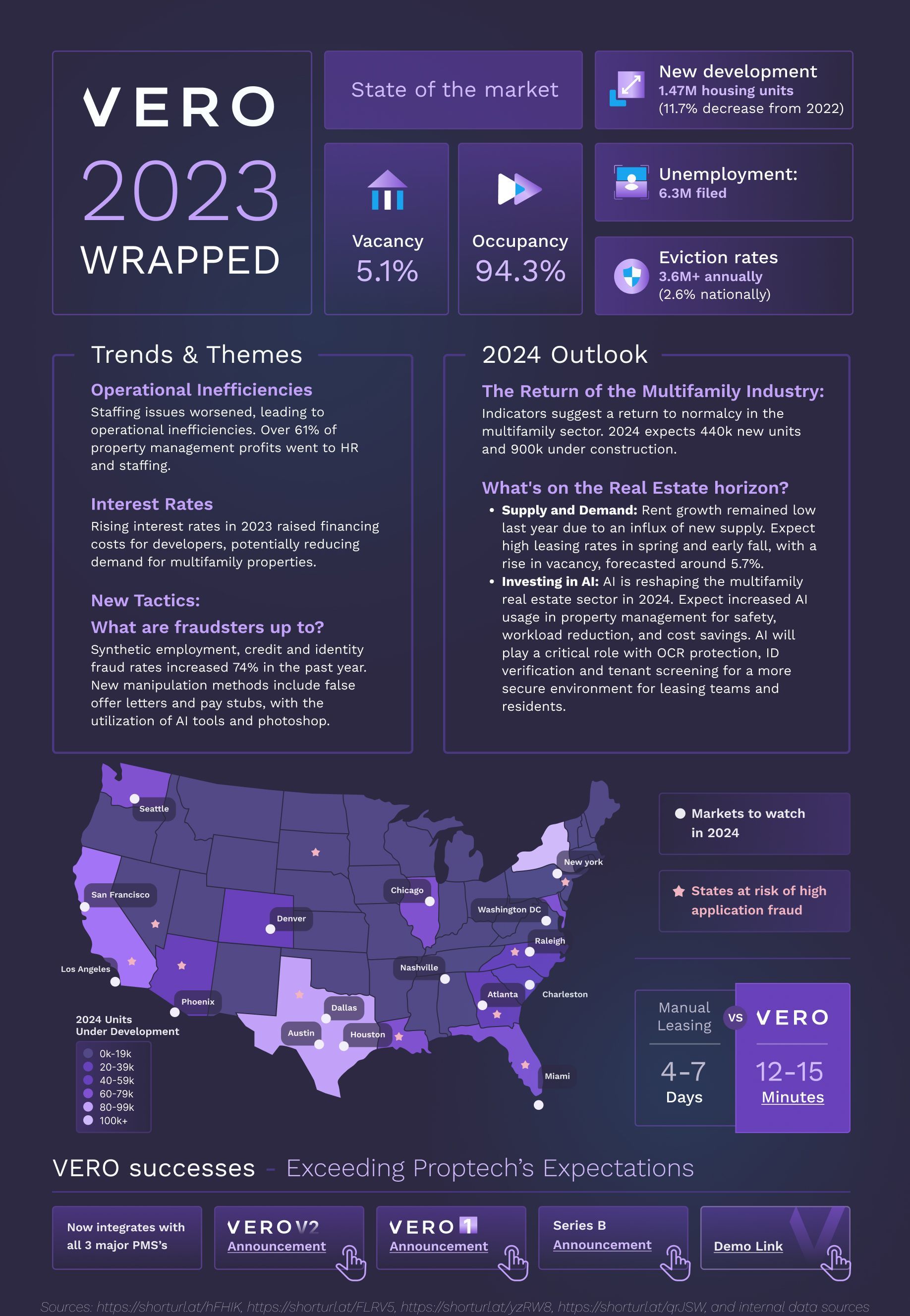

Trends & Themes

Operational Inefficiencies

Staffing issues worsened, leading to operational inefficiencies. Over 61% of property management profits went to HR and staffing.

Interest Rates

Rising interest rates in 2023 raised financing costs for developers, potentially reducing demand for multifamily properties.

New Tactics: What are fraudsters up to?

Synthetic employment, credit, and identity fraud rates increased 74% in the past year. New manipulation methods include false offer letters and pay stubs, utilizing AI tools and Photoshop.

Unveiling VERO's 2023 Wrapped!

2023 was a transformative year in the rental market. These economic challenges had a profound impact on both operators and applicants, reshaping the dynamics of applying for a home and the need for efficient solutions like VERO to drive occupancy. Check out our insights on the year and what's to come in 2024 below!

2024 Outlook

The Return of the Multifamily Industry:

Indicators suggest a return to normalcy in the multifamily sector. 2024 expects 440k new units and 900k under construction.

What's on the Real Estate horizon?

- Supply and Demand: Rent growth remained low last year due to an influx of new supply. Expect high leasing rates in spring and early fall, with a rise in vacancy, forecasted around 5.7%.

- Investing in AI: AI is reshaping the multifamily real estate sector in 2024. Expect increased AI usage in property management for enhanced safety, reduced workload, and cost savings. AI will play a critical role with OCR protection, ID verification, and tenant screening for a more secure environment for leasing teams and residents.